How To Claim Gi Bill On Taxes

bill taxes wallpaperTo figure the amount of credit you must first subtract the 3840 from your qualified education expenses because this payment under the GI Bill was required to be used for education expenses. You also want to claim an American Opportunity Credit on your return.

Military Taxes How To Pay Your Taxes While Deployed

Military Taxes How To Pay Your Taxes While Deployed

Not Taxable But More Calculations May Be Needed To Claim Certain Tax Breaks.

How to claim gi bill on taxes. You paid 5000 in qualified education expenses. However youre looking to claim a Lifetime Learning Credit on your return and you paid 6000 in qualified education expenses. Claim a tax refund You may be able to get a tax refund rebate if youve paid too much tax.

Find out how to apply for the GI Bill and other VA education benefits as a Veteran service member or qualified family member. Payments received for education training or subsistence under any law administered by the Department of Veterans Affairs VA are tax-free. The various federal education benefits arent just for you.

If you prefer to have the application mailed to you call 1-888-GI BILL- 1 888-442-4551. You will have to do some calculations but you can potentially save on your taxes by doing so. Department of Veterans Affairs VA will pay tuition equal to the most expensive public college tuition in the state and under some circumstances the government may pay even more.

You will now be able to tab or arrow up or down through the submenu options to accessactivate the submenu links. No taxes zip nada. If the GI Bill pays for your tuition and fees you cant deduct tuition and fees on your taxes and you cant claim the American Opportunity Credit.

If you pay qualified education expenses with certain tax-free funds GI Bill Pell grants military tuition assistance employer-provided assistance you cannot claim a deduction for those. Youll answer questions about your military and educational background as well as the school youd like to attend. Get help from Veterans Crisis Line.

You also want to claim an American opportunity credit on your return. If your claim is for the current tax year HM Revenue and Customs HMRC will usually make any adjustments needed. Hit enter to expand a main menu option Health Benefits etc.

To figure the amount of credit you must first subtract the 4000 from your qualified education expenses because this payment under the GI Bill was required to be used for education expenses. The IRS Pub 520 reads. The amount you can claim is 2000.

To figure the amount of credit you must first subtract the 3840 from your qualified education expenses because this payment under the GI Bill was required to be used for education expenses. You also want to claim an American opportunity credit on your return. 6000 Qualified education expenses paid 4000 GI Bill benefits received.

Under the Post-911 GI Bill the US. Therefore if you paid 5000 in qualified education expenses and got 3840 from the GI Bill you can only claim 1160 for the tax credit 5000 - 3840 You do not subtract any amount of the. You can apply online by mail in person or with the help of a trained professional.

Use this service to see how to claim if you paid too much on. Your total tuition charges are 5000. How to Apply for the GI Bill Apply at a nearby VA regional office or online.

Pay from your current or previous job. 4000 in GI Bill benefits. You must claim within 4 years of the end of the tax year that you spent the money.

This is calculated as follows. These benefits are NOT taxable. The bill also provides.

Up to 1000 for school books and supplies. In the 2016 IRS publication Tax Benefits For. You do not subtract any amount of the BAH because it was paid to you and its use was not restricted.

Benefits for GI Bill recipients. Report them on your tax return. No taxes on income.

Please switch auto forms mode to off. At this point its important to note that tax laws change frequently and what applied last year may be different in successive years depending on legislation tax reform or other developments. To figure the amount of credit you must first subtract the 3840 from your qualified education expenses because this payment under the GI Bill was required to be used for education expenses.

To enter and activate the submenu links hit the down arrow. Is the GI Bill considered taxable income The answer is NO. The one situation where you might be able to claim a deduction is if you go to a school where the GI Bill does NOT pay for all your qualified tuition and fees.

Your total tuition charges are 5000. No deductions if GI Bill pays the expenses. If you pay for your spouse or your dependents to attend school you can claim tax credits or tuition deductions for them too if they meet the requirements.

To calculate the amount to apply toward the credit deduct the amount the GI Bill paid toward your tuition from the total amount paid and the remaining amount is your qualified expense for tax credit purposes. You can also transfer your GI Bill benefits to your family members so that they can use them to attend school.

Repairs Vs Improvements Why It S Important

Repairs Vs Improvements Why It S Important

All Veteran Property Tax Exemptions By State And Disability Rating Property Tax Military Benefits Veteran

All Veteran Property Tax Exemptions By State And Disability Rating Property Tax Military Benefits Veteran

Tax Saving Tips For 2020 Morningstar

Tax Saving Tips For 2020 Morningstar

Http Equity Psu Edu Veterans Pdf Student Veterans And Irs Form 1098t

How To Claim The Working From Home Tax Relief Times Money Mentor

How To Claim The Working From Home Tax Relief Times Money Mentor

Are Gi Bill Payments Taxable Military Com

Are Gi Bill Payments Taxable Military Com

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) Social Security Tax Definition

Social Security Tax Definition

Tax Credits And Deductions For A College Education Education College Tax Credits Tax Prep

Tax Credits And Deductions For A College Education Education College Tax Credits Tax Prep

Tax Hacks 2017 Don T Miss These 16 Often Overlooked Tax Breaks Diy Taxes Financial Apps Capital Gains Tax

Tax Hacks 2017 Don T Miss These 16 Often Overlooked Tax Breaks Diy Taxes Financial Apps Capital Gains Tax

Are Gi Benefits Considered Income On Your Tax Return Turbotax Tax Tips Videos

Are Gi Benefits Considered Income On Your Tax Return Turbotax Tax Tips Videos

Tax Credits For Hiring Veterans Military Benefits

Tax Credits For Hiring Veterans Military Benefits

404 Not Found Career Vision Board Vet Benefits Rehab

404 Not Found Career Vision Board Vet Benefits Rehab

Van Purchase Confused Accounting Quickfile

Van Purchase Confused Accounting Quickfile

Free Tax Filing For Military Members Military Benefits

Free Tax Filing For Military Members Military Benefits

Faq How Do I Claim My Solar Tax Credit Tax Credits Tax Credits

Faq How Do I Claim My Solar Tax Credit Tax Credits Tax Credits

Policy Basics Where Do Our State Tax Dollars Go With State Revenues Still Deeply Damaged By The Recession Policymaker Budgeting Higher Education State Police

Policy Basics Where Do Our State Tax Dollars Go With State Revenues Still Deeply Damaged By The Recession Policymaker Budgeting Higher Education State Police

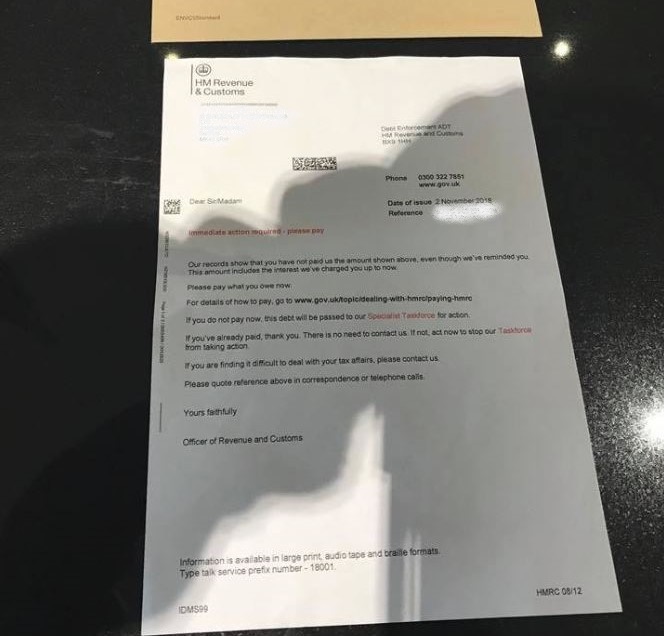

I Have Received A Debt Letter From Hmrc Is It Real Low Incomes Tax Reform Group

I Have Received A Debt Letter From Hmrc Is It Real Low Incomes Tax Reform Group

Health Insurance Policy Health Insurance Health Insurance Plans Buy Health Insurance

Health Insurance Policy Health Insurance Health Insurance Plans Buy Health Insurance

Pin On It Security And Security Operations Secops

Pin On It Security And Security Operations Secops

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer