Imf Issues Sdr

issues wallpaperUnder current IMF procedures each US. The IMF issues SDRs to its member countries central banks as a reserve asset ie an asset they can easily exchange for hard currency with another central bank.

Reading What Is The Role Of The Imf And The World Bank International Business

Reading What Is The Role Of The Imf And The World Bank International Business

When the IMF issues SDR members receive them in proportion to their IMF quota subscriptions.

Imf issues sdr. A decision by the IMF executive board for example on May 1 2020 to allocate 500 billion of SDR can be implemented by early August when the economic effects of the pandemic will still be raging. Dollar equivalent is calculated on the basis of the mid-market rates as provided to the IMF by the Bank of England based on spot exchange rates observed at around noon London time see Bank of England website. SDRs The IMF issues an international reserve asset known as Special Drawing Rights SDRs that can supplement the official reserves of member countries.

The value of the SDR is based on a basket of five currenciesthe US. The paper looks into how those weaknesses can be mitigated by three concepts of the SDR. They represent a claim to currency held by IMF member countries for which they may be exchanged.

The paper explores whether a broader role of the SDR could contribute to the smooth functioning and stability of the international monetary system IMS. The IMF can issue an unlimited amount of SDRs to IMF member states through general allocations so long as the issuance is in proportion to member state quotas a figure based on a countrys size and contributions to the IMF. Those weaknesses together with the expansion of the SDR basket have renewed interest in the SDR and motivated a discussion of whether there is an economic rationale for a broader SDR role.

So far SDR 2042 billion equivalent to about US281 billion have been allocated to members including SDR 1826 billion allocated in 2009 in the wake of the global financial crisis. The IMF issues SDRs to its member countries central banks as a reserve asset ie an asset they can easily exchange for hard currency with another central bank. Special drawing rights SDR refer to an international type of monetary reserve currency created by the International Monetary Fund IMF in 1969 that operates as a supplement to the existing money.

The IMF issues SDRs by way of general allocations. Member countries hold them at the Fund in proportion to their shareholdings. The official SDR the reserve asset administered by the IMF O-SDR.

The IMF issues SDRs to its member countries central banks as a reserve asset ie an asset they can easily exchange for hard currency with another central bank. Various economists have estimated that as a supplement to other reserve assets the IMF could issue 200 billion300 billion in SDRs annually. SDR-denominated financial instruments or market SDRs M-SDR.

Dollar the euro the Chinese renminbi the Japanese yen and the British pound sterling. The ISO 4217 currency code for special drawing rights is XDR and the numeric. Most central banks.

The IMF issues SDRs to its member countries central banks as a reserve asset ie an asset they can easily exchange for hard currency with another central bank. Members can also voluntarily exchange SDRs for currencies among themselves. Dollar in terms of the SDR is.

Most central banks voluntarily. Special drawing rights are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund. The SDR is not a loan from the IMF but a claim recognized by all IMF member states on each others holdings of reserve currencies.

The SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries official reserves. SDR should be allocated quickly to maximize their positive impact on global economic confidence and their usefulness to recipient countries. IMF Rule O-2a defines the value of the US.

Dollar in terms of the SDR as the reciprocal of the sum of the equivalents in US. The major limitation on the use of SDRs is the division between the IMFs general resources and SDR accounts which limits the use of SDRs to payments among central banks. Two allocations in August and September 2009 increased the outstanding stock of SDRs almost ten-fold to total about SDR 204 billion US310 billion.

Members cannot directly make international payments using SDRbecause the SDR is not itself a currencybut they can transfer SDR to another IMF member for the equivalent in a convertible or hard currency for example US dollars or euros. And the SDR as a unit of account U-SDR. Most central banks voluntarily carry out the exchange but if not the IMF has the power to decree who must accept the SDRs.

SDRs are units of account for the IMF and not a currency per se. Dollars of the amounts of the currencies in the SDR basket. SDRs were created in 1969 to supplement a shortfall of preferred foreign exchange reserve assets namely gold and US.

SDRs are limited to governments only and are booked at the IMF. The value of the US. SDRs USDXDRR based on dollars euro yen sterling and yuan are the IMFs official unit of exchange.

On March 30 2018 the Executive Board of the International Monetary Fund IMF discussed a staff paper entitled Considerations on the Role of the SDR.

It S Time For A Major Issuance Of The Imf S Special Drawing Rights Financial Times

It S Time For A Major Issuance Of The Imf S Special Drawing Rights Financial Times

Imf Lending Stand By Eff And Prgf Arrangements As Of September 30 Imf Survey Volume 33 Issue 20

Imf Lending Stand By Eff And Prgf Arrangements As Of September 30 Imf Survey Volume 33 Issue 20

The Chairman S Summing Up Considerations On The Role Of The Sdr Executive Board Meeting 18 27 March 30 2018 Ebm 18 27

The Chairman S Summing Up Considerations On The Role Of The Sdr Executive Board Meeting 18 27 March 30 2018 Ebm 18 27

Tom Orlik On Twitter Chart Bloomberg Business History

Tom Orlik On Twitter Chart Bloomberg Business History

Unchallenged Currencies And The Imf Atlantic Council

Unchallenged Currencies And The Imf Atlantic Council

By Laws Rules And Regulations Of The International Monetary Fund Sixty Fifth Issue November 2019

By Laws Rules And Regulations Of The International Monetary Fund Sixty Fifth Issue November 2019

The Future Of The Imf S Special Drawing Right Sdr Imf F D December 2019

The Future Of The Imf S Special Drawing Right Sdr Imf F D December 2019

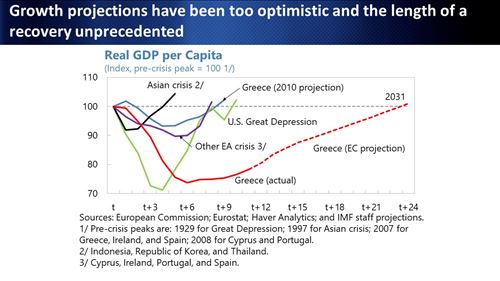

Criticisms Of Imf Economics Help

Criticisms Of Imf Economics Help

4 Special Drawing Rights Imf Financial Operations 2018

4 Special Drawing Rights Imf Financial Operations 2018

Imf And World Bank Decision Making And Governance Bretton Woods Project

Imf And World Bank Decision Making And Governance Bretton Woods Project

Explaining Sdrs Special Drawing Rights Drawings Special Japanese Yen

Explaining Sdrs Special Drawing Rights Drawings Special Japanese Yen